To help address unfunded pension costs, the Santa Cruz City Council is again considering potential new taxes. (Kara Meyberg Guzman – Santa Cruz Local file)

SANTA CRUZ >> On the heels of a $284 million Santa Cruz city budget approved this month, city leaders are again considering whether to ask voters to approve new taxes to help close the gap on a projected deficit caused in part by pension costs.

- Spending from Santa Cruz’s General Fund is about $7 million higher than last fiscal year and includes 10 new city staff.

- Though federal COVID-19 relief money left the city with a surplus, city staff predict the city will burn through its reserves within 10 years.

- The projected revenue shortfall is largely driven by pension costs, which continue to grow but are expected to level by 2030, city staff said.

- An upcoming long-term planning report will include suggestions for new sources of city money, staff said.

This year’s budget process was “a very difficult season to navigate” following years of financial turbulence from the COVID pandemic, said Santa Cruz City Manager Matt Huffaker. Huffaker started the role in early 2022. “Long term, we still have a lot of work to do to get to a point where we’re more stable,” he said.

As costs rise more quickly than revenues, the city officials are still finding “the new normal,” said Santa Cruz Finance Director Elizabeth Cabell. “We keep comparing things to 2019, and we can’t continue to do that.”

Employee pension costs

All of the city’s costs are increasing, including supplies, city services and salaries, Cabell said. But pensions are “obviously a huge piece” of the projected revenue shortfall, she said.

- Previous city finance directors have also said that rising pension costs were a large part of projected city budget deficits.

- As of June 2022, the city had $162.4 million in unfunded pension and benefit-related liabilities, according to the proposed 2024 budget.

- Pensions have grown from about 21% of payroll costs in 2019 to about 26% of payroll costs in 2022, Cabell wrote in an email in June.

As pension costs continue to rise, the city will begin drawing from a $7.5 million pension reserve, a separate fund from the city’s General Fund reserve. The city could use money from the pension reserve as early as fiscal year 2026, Cabell said. The long-term financial plan will include suggestions on how the city can best use the reserve to soften spikes in pension costs.

Although the rising pension costs represent a challenge over the coming years, Cabell said they don’t represent a long-term crisis. Pension costs are expected to stabilize around 2030, she said. That’s because much of the city’s existing pension debt is from staff who retired before state pension reform efforts in 2013. Staff who were hired after 2013 switched to a newer pension system that raises the retirement age and increases employee contributions.

That plan is “a much more financially stable pension tier than what we’ve historically experienced,” Huffaker said.

Potential tax hikes

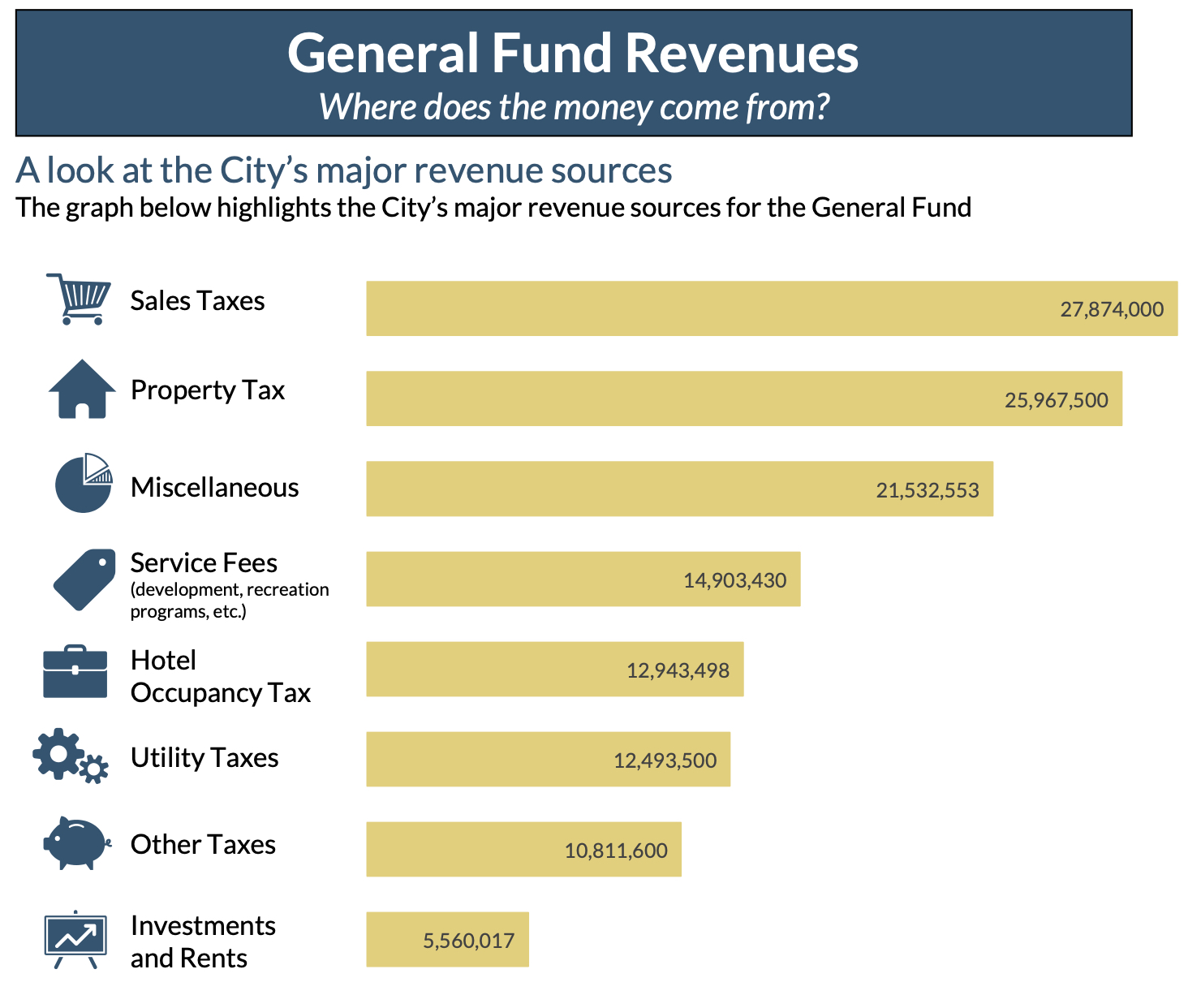

City staff are working with Sacramento-based consultant Baker Tilly to create a long-range financial plan. The plan will include new potential sources of income, like new or raised taxes. The city council Ad Hoc Budget and Revenue Committee has discussed new possible taxes that could be placed on the ballot, including an increased sales tax or a tax on disposable cups, Cabell said.

City leaders previously placed a sales tax hike on the ballot in June 2022. The measure failed with 49.85% of the vote.

The city may also need to raise the fees it charges for city services, Huffaker said. Fees for renting a park, submitting building plans and a variety of other services may cost less than the city pays in staff time and materials, he said. The city plans to hire a consultant to lead a study of the true cost of city services. After the study is completed, staff plan to consider raising some fees during the next budget cycle, Huffaker said.

New sources of city money will help long-term efforts for new buildings and other major projects, Cabell said. “It’s not just a year at a time,” she said. “What do we need to be sustainable five, 10, 15, 20 years down the road?”

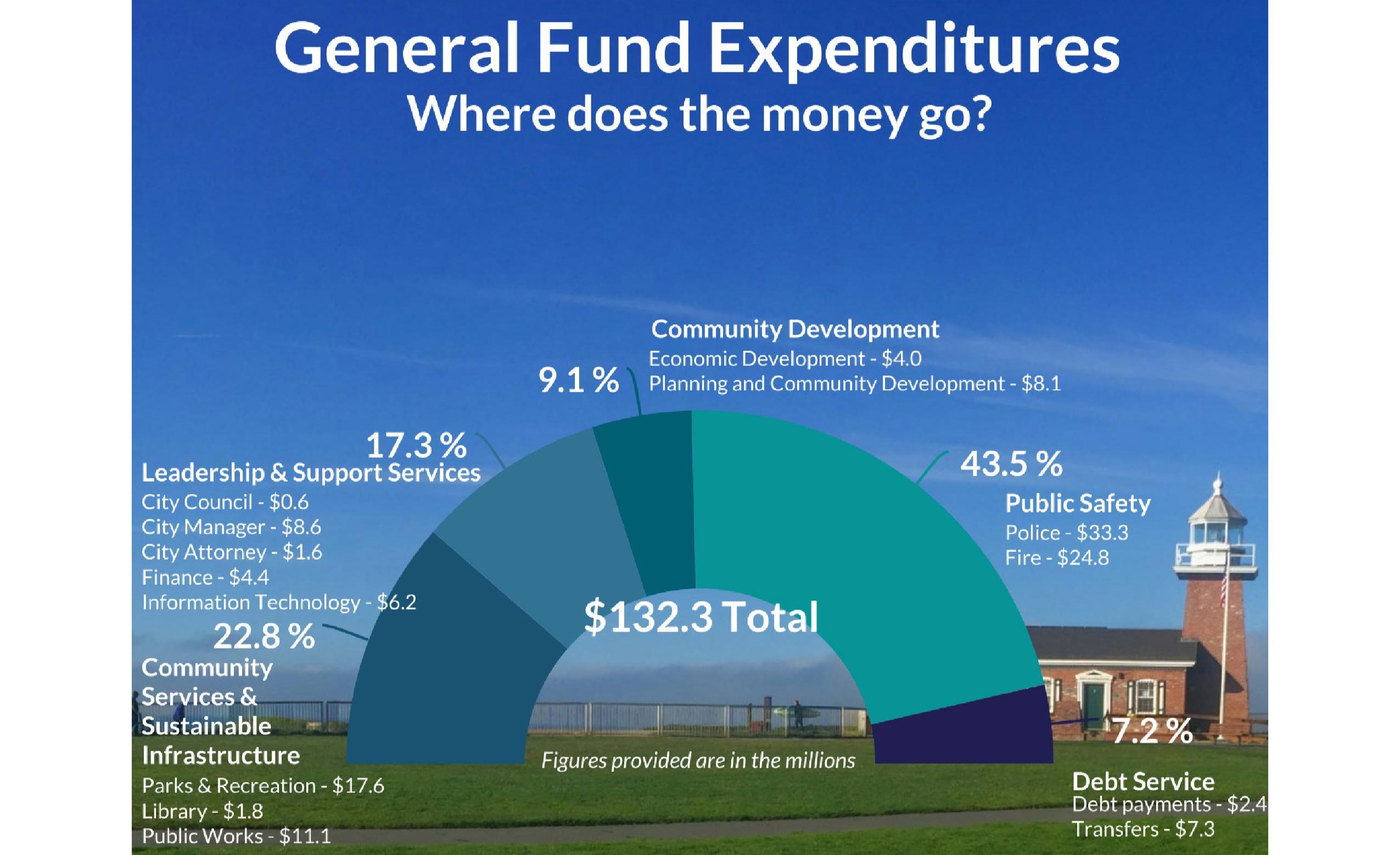

A chart from the budget for the upcoming fiscal year shows that the largest city expenses are police and fire protection, community services and infrastructure. (City of Santa Cruz)

Budget details

Nearly half of the budgeted expenses draws from the city’s General Fund, which is funded in large part by sales taxes, property taxes and hotel taxes. The approved $133.6 million in General Fund spending is up from the $126.8 million approved for the current fiscal year, and includes 10 new city staff.

The department breakdown of the proposed $133.6 million of General Fund spending includes:

- Police: $33.3 million.

- Fire: $24.8 million. Includes one new position to manage the fire department’s budget and apply for grants and disaster funding.

- Parks and recreation: $17.5 million. Includes two full time and one part time new staff for maintenance of city parks and managing recreation.

- Public works: $11.1 million.

- City manager’s office: $8.6 million. Includes a new position to help coordinate the city’s homelessness response and other city efforts.

For the first time, the proposed budget includes $2.7 million in General Fund spending on homelessness response. The city’s three-year homelessness response plan, adopted by the council last year, was expected to cost $14.5 million from July 1, 2022 through June 2023. The cost was almost entirely covered by one-time money from the state legislature. Once those funds are depleted, the city will pay for a portion of the plan.

Despite the increase in spending, Cabell said in an interview that the city has been “ultra conservative” in its budgeting, and that the increase represents rising costs of maintaining the city’s current services. “We can’t cut those expenses without cutting people,” she said.

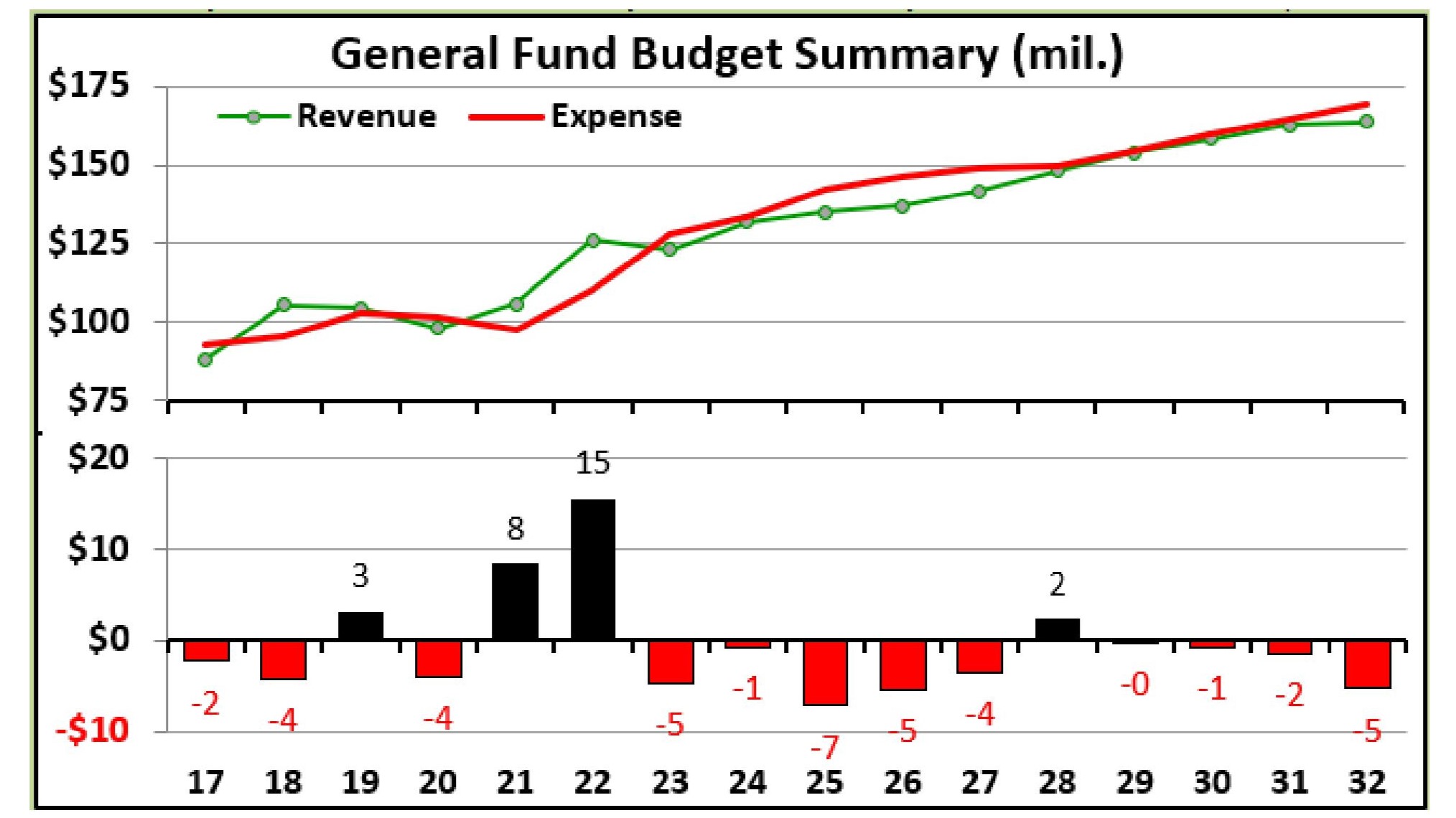

A chart from the budget report shows that without budget cuts or new sources of money, city costs will outpace income over the next 10 years. (City of Santa Cruz)

Long-term outlook

The city ended fiscal year 2020-2021 and fiscal year 2021-2022 with a combined surplus of $23.1 million, according to a budget report by Cabell. The city’s fiscal year starts July 1. City funds were bolstered by $8.5 million in one-time federal money related to economic recovery from the COVID-19 pandemic.

But the city’s long-term forecast is rocky. Though the city’s sales tax and hotel tax have rebounded over the past fiscal year, city revenues aren’t growing quickly enough to meet rising costs, according to a budget report written by Cabell.

In 2022 and 2023, the city has reached new agreements with seven bargaining groups that represent city workers. The agreements include “some of the largest cost-of-living adjustments that we’ve had,” Huffaker said. The pay of some city employees will increase by up to 12% by 2025, according to city documents. The pay increases are a recognition of the rising cost of housing in the region, Huffaker said, and will help “ensure that our employees are able to live and work in the community that they serve.”

Without new revenue or major cuts, the city will have to dip into its $7 million emergency reserves. By 2026, the city’s reserves are expected to fall below the city’s target, and by 2032, the reserves will be depleted, Cabell wrote.

Major cuts to staffing or city services are “not something that we want to look at at all,” Cabell said. Instead, the city needs new ways to raise money, she said.

A chart from the budget report shows sales tax and property tax as the biggest sources of money for the city budget. City leaders will consider increasing fees for services and placing a sales tax increase on a future ballot, staff said. (City of Santa Cruz)

Correction: A previous version of this story contained incorrect information about funding for a new position in Public Works.

Questions or comments? Email [email protected]. Santa Cruz Local is supported by members, major donors, sponsors and grants for the general support of our newsroom. Our news judgments are made independently and not on the basis of donor support. Learn more about Santa Cruz Local and how we are funded.

Jesse Kathan is a staff reporter for Santa Cruz Local through the California Local News Fellowship. They hold a master's degree in science communications from UC Santa Cruz.