Rising pension costs are “a big part” of Santa Cruz’s structural deficit, city Finance Director Kim Krause said. (Kara Meyberg Guzman — Santa Cruz Local file)

Editor’s note: Santa Cruz Local’s team digs in to reader and listener questions. Submit your questions to [email protected].

Several Santa Cruz Local readers said they wanted to know more about the City of Santa Cruz’s rising pension costs. As the Santa Cruz City Council prepares to adopt the city budget for the next fiscal year at its June 8 meeting, Santa Cruz Local pressed city Finance Director Kim Krause with readers’ budget questions and concerns.

Scroll for answers to these questions:

- How much of Santa Cruz’s deficit is due to pension costs?

- Could the city raise taxes to address the deficit?

- Are Santa Cruz leaders considering pension obligation bonds?

- What more can city leaders do to address rising pension costs?

- What are highlights of the proposed budget?

For the next 10 years, Santa Cruz leaders forecast $1 million to $5 million annual deficits, according to the draft budget. How much of that deficit is due to pension costs?

Rising pension costs are “a big part” of the deficit, Krause said.

- The annual cost for Santa Cruz employee pensions is expected to grow from $14 million in 2022 to $22 million by 2030. Pensions are expected to account for about 12% of the city’s General Fund expenses in the next fiscal year and 16% by 2030, Krause said.

- Cities across the state face rising pension costs. CalPERS, the state agency that manages retirement benefits for public employees, invests in the stock market and real estate to help pay for those benefits. CalPERS’ rate of return on its investments has dropped since the 1990s, which means that CalPERS contributes less money for employee plans and cities contribute more. The last recession exacerbated CalPERS’ losses.

Krause listed two more reasons for why the city’s expenses are expected to exceed revenues:

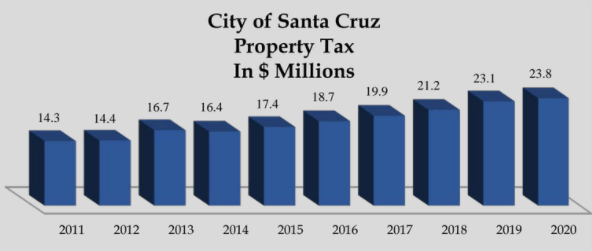

- Slow growth of property tax revenue: Property taxes are the main revenue source for the city’s General Fund. The General Fund funds parks, police, economic development, planning, homelessness-related costs and other city services. Krause said California’s Prop. 13 restrictions on property tax growth prevents property tax revenue from matching growth in city expenses.

- Other employee costs: Employee costs account for about two-thirds of General Fund expenses.

The City of Santa Cruz’s property tax revenue has grown since the last recession. (Source: City of Santa Cruz 2020 Comprehensive Annual Financial Report)

Could the city raise taxes to address the deficit?

In June, the city council is expected to discuss a possible ballot measure potentially to raise a local tax, City Manager Martín Bernal said in a May 25 Santa Cruz City Council budget hearing. Then it would be up to city voters to decide.

Bernal did not say what type of tax. “Without the addition of new revenue sources to the city, we do face deficits over the long term so it is really essential to our long-term sustainability,” Bernal said.

- In fall 2019, prior to the pandemic, the council discussed the placement of a hotel tax increase on the November 2020 ballot. It did not move forward. A council committee has continued to study the issue.

- A polling firm in 2019 showed a tax increase would be difficult to pass, due to “low approval ratings for the City Council and some City city departments, a lack of sufficient proportional consensus that the city is in significant need of more money, and the possibility of organized opposition,” according to a 2019 staff report.

- Krause, the finance director, declined to comment on the proposal during a June 1 interview. A recent poll was conducted, Krause said, but its results have not been made public.

To address growing pension costs, local agencies including the city of Scotts Valley, the Santa Cruz County Board of Supervisors and the Santa Cruz Metropolitan Transit District are considering pension obligation bonds. Are Santa Cruz city leaders considering these bonds to address growing pension costs?

- Pension obligation bonds are bonds that local governments issue when interest rates are low to help pay off unfunded pension liabilities. However, many experts including the Government Finance Officers Association consider those bonds risky because if the market crashes, local governments’ debt grows.

- The city of Santa Cruz issued pension obligation bonds for $24.1 million in 2011. The city will complete its scheduled payments for those bonds next fiscal year. Those bonds are expected to save the city $3.2 million, Krause said.

- Neither city staff nor the Santa Cruz City Council has proposed issuing more pension obligation bonds. Krause said she looked into it and concluded that pension obligation bonds are not a good idea. “On the surface it seems like ‘Well, hey, if you reduce your interest rate to 3.5%, that should be a good deal,’” Krause said. “But then your unfunded liability is likely to come back if (Cal)PERS doesn’t make their returns on investment. So then I’m like, well then you have the debt — and you have the unfunded liability.”

What more can city leaders do to address growing pension costs?

Krause said she could not think of anything more that city leaders could do.

According to the city’s 2020 Comprehensive Annual Financial Report, city leaders have taken the following steps in recent years:

- All of the city’s employee bargaining units have agreed to share the cost of pension plans.

- City leaders established a “Section 115 Trust Fund” to help pay for unfunded liabilities for pensions and other retirement benefits such as health insurance.

- The city contributed about $12.4 million to CalPERS in 2019 to pay down the city’s unfunded pension liabilities to help lower future payments and interest costs.

In 2011 and 2013 city leaders also created lower-cost pension tiers for new employees. Employees in the lower tiers contribute more to their pension plans.

The League of California Cities lobbies on behalf of cities for pension sustainability. In a 2018 report, the league listed six recommendations for cities to exercise their “limited options” under state law to address rising pension costs. Santa Cruz leaders have used all six of those approaches to some extent in recent years.

- Examples include local ballot measures to grow revenue, Section 115 Trust Funds and negotiation to increase employee pension contributions.

To reduce financial risk, city leaders cut General Fund spending each year since fiscal year 2017-18. However, the proposed $112.2 million General Fund for next year would be the city’s largest annual General Fund spending in several years.

- General Fund spending is expected to be $99 million for the fiscal year that ends June 30. It was $103.5 million for fiscal year 2019-20 and $104.3 million for fiscal year 2018-19.

- City leaders expect to receive $14 million in one-time federal American Rescue Plan Act money. The draft budget assumes receipt of the money.

The Santa Cruz County Civil Grand Jury reviewed Santa Cruz’s and other local jurisdictions’ financial risk related to pensions and other costs in a 2020 report. The grand jury made 11 recommendations for the City of Santa Cruz and other local jurisdictions.

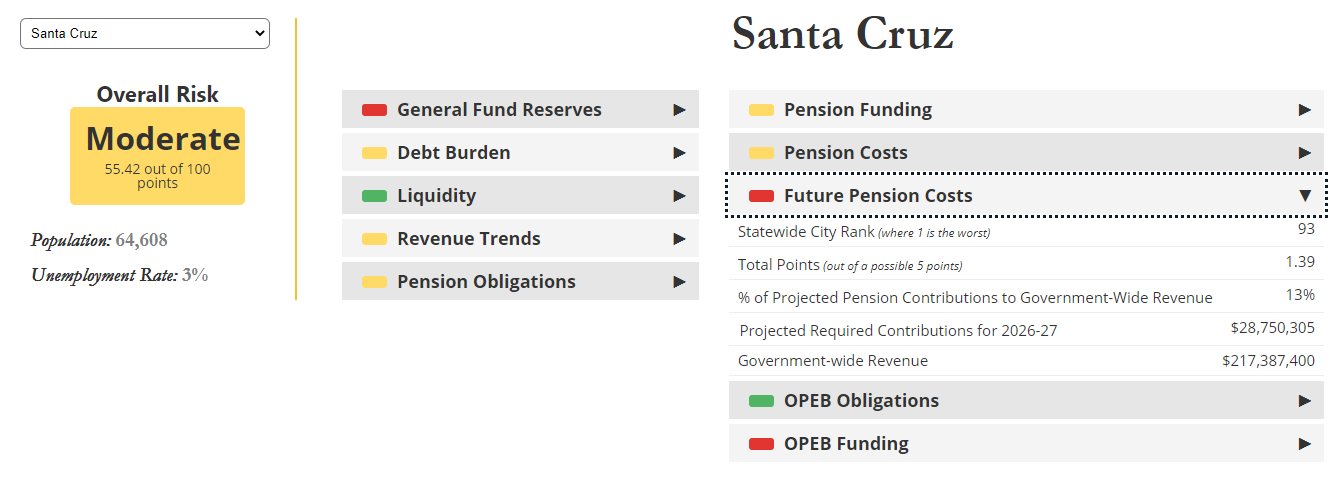

The California state auditor ranks Santa Cruz among the highest-risk cities in the state for future pension costs. Click the image to see the dashboard. (California State Auditor’s website)

Examples include:

- Adoption of the state auditor’s office risk assessment framework. The state auditor ranked the City of Santa Cruz as among the highest-risk cities in California for the following financial indicators: General Fund reserves, future pension costs and funding for other retirement benefits. The rankings are based on 2018-19 data.

- Development of a policy on control of retirement benefits and funding plans for unexpected CalPERS bills

In a formal response to the civil grand jury in March, Santa Cruz leaders wrote that they did not plan to implement nine of the 11 recommendations. The Santa Cruz City Council approved the response. Reasons for rejection of included:

- “Under the current economic, health, and social mandates, the city does not have the capacity to evaluate whether this should be implemented, and whether the benefits would outweigh the costs,” city staff wrote regarding five of the recommendations.

- “The city has taken many steps to control pension and other post-employment benefits. The city negotiated for employees to pay part of the city’s share of the CalPERS retirement obligation. The city has also limited other post-employment retirement benefits to flat monthly amounts for eligible retirees. If significant shortfalls were projected in the long-term forecast, the city would take additional steps to control those costs, up to and including negotiating with the city’s unions for additional cost-sharing,” city staff wrote.

What are other highlights of Santa Cruz’s proposed budget for fiscal year 2021-22?

The draft budget restores most of last year’s cuts, lifts a hiring freeze and does not include furloughs. The draft budget includes cuts to the following departments:

- Parks and Recreation ($617,000 cut): Reduced budgets for San Lorenzo River levee maintenance, homeless camp cleanup, and tree work in wildlands. City staff plan to search for grants to support camp cleanups. Annual events such as Woodies on the Wharf and the Japanese Cultural Fair would not receive financial support from the city. Temporary staff for the Civic Auditorium would be reduced. City staff plan to focus money and staff on high-demand areas that generate revenue, such as sports programs and child care, Parks and Recreation Director Tony Elliot said May 26.

- Public Works ($348,000 cut): About $107,000 of savings is due to a grant for the city’s “Local Roadway Safety Plan.” Cuts include $63,700 to street materials and services. “A lot of this street work has been shifted to homeless cleanups and so some of this materials (budget) has not been spent, so we think we’ll be fine this year by reducing it,” Public Works Director Mark Dettle said May 26.

- Economic Development ($181,000 cut): Cuts include reduced temporary staff, training, trolley operations and property management.

- Finance ($79,000 cut)

The General Fund capital improvement program, which funds major public facility construction projects, would be mostly unfunded. Street resurfacing projects would not be funded next year.

- The city’s unfunded capital improvement projects total more than $307 million. Unfunded transportation projects account for about $242 million.

Participate in Tuesday’s meeting

The city council is expected to adopt the next fiscal year’s budget at its meeting 9 a.m. Tuesday June 8. The budget hearing likely will be in the afternoon. Watch on Zoom or call 1-833-548-0276, meeting ID 946 8440 1344. To comment before the meeting, email [email protected] by 5 p.m. Monday.

Become a member of Santa Cruz Local, an independent, community-supported newsroom that’s owned and led by local journalists. Our stories are free and always will be, but we rely on your support.

Already a member? Support Santa Cruz Local with a one-time gift.

Kara Meyberg Guzman is the CEO and co-founder of Santa Cruz Local. Prior to Santa Cruz Local, she served as the Santa Cruz Sentinel’s managing editor. She has a biology degree from Stanford University and lives in Santa Cruz.