SANTA CRUZ >> Santa Cruz city voters will not see a 0.5% sales tax increase on their ballots this November, but the measure could still end up on ballots in June or next November.

Friday was the deadline for city leaders to approve a declaration of fiscal emergency by unanimous consent, a necessary step for the sales tax to appear on November ballots.

The sales tax was one way for the city to address budget problems in coming years. Santa Cruz leaders forecast $1 million to $5 million annual deficits for the next decade. The city’s structural deficit predates the pandemic. It’s caused largely by rising pension and health care costs for public employees. In 2020, pandemic-related shutdowns caused at least $10 million in revenue losses for the city, partly due to a drop in hotel tax money.

- The annual cost for Santa Cruz employee pensions is expected to grow from $14 million in 2022 to $22 million by 2030. Pensions are expected to account for about 12% of the city’s General Fund expenses in the next fiscal year and 16% by 2030, Santa Cruz Finance Director Kim Krause said.

- The city’s sales tax was increased by 0.25% in June 2018. About 71% of city voters approved the increase. Rising pension costs were among city leaders’ reasons for the 2018 sales tax increase.

The city needs an additional source of revenue, officials said. A City Council Revenue Ad Hoc Committee — made up of Mayor Donna Meyers, Vice Mayor Sonja Brunner and Councilmember Justin Cummings — studied various options and hired a firm to poll city residents. Earlier this year, the committee recommended a 0.5% sales tax increase to 9.75%. It could generate $6 million per year, city leaders said.

To get the proposal on the ballot, state law required the city council’s unanimous declaration of a fiscal emergency, Assistant City Manager Laura Schmidt told Santa Cruz Local.

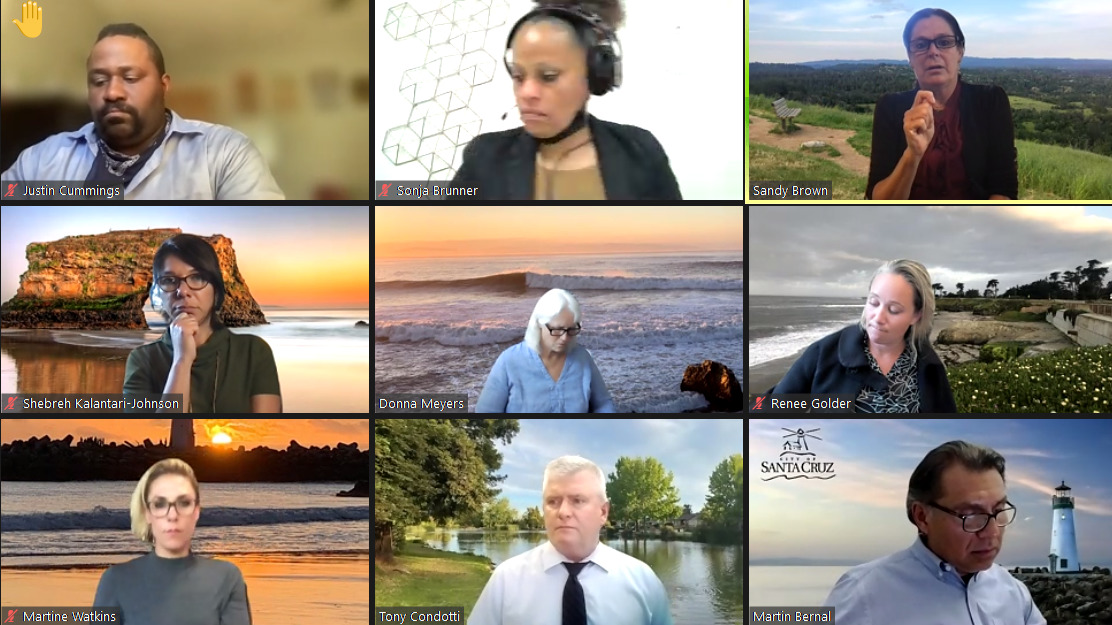

But on June 22, when the city council took the fiscal emergency vote, it failed. Councilmember Sandy Brown cast the lone ‘no’ vote because she wanted a living wage for all city employees.

What happened?

Santa Cruz City Councilmember Sandy Brown explains her “no” vote at the June 22, 2021 city council meeting. (Zoom screenshot)

Brown said she could not support the measure because she considers a sales tax to be “regressive,” placing an undue burden on the city’s poorest residents. She wouldn’t approve it unless she could lock in some guarantees that the city would allocate resources to low-wage city workers, she told Santa Cruz Local.

Using her leverage as the only vote against the fiscal emergency, Brown in recent weeks met with Brunner and Councilmember Renee Golder to draft a living wage proposal. Brown intended to propose it at a special meeting by Aug. 6. The council could reconsider the fiscal emergency at that same meeting.

State law would require Santa Cruz to keep money from the proposed sales tax increase in the General Fund. The money could not be earmarked for a specific use. However, Brown said she saw it as an opportunity to lock in some assurances for low-wage workers, even if the sales tax dollars couldn’t be set aside for them.

Her pitch, co-signed by Brunner, was two-pronged:

- Ask staff to set aside a total of $500,000 for current contract negotiations with SEIU, a labor union representing some city workers, for this fiscal year, Brown said.

- That infusion of cash – more than the city had previously set aside for union negotiations — could come from unfilled, budgeted salary positions and bring most temporary and other workers up to a living wage, Brown said.

- Union representatives have held individual meetings with council members recently to lobby for higher pay for these and other city jobs. An SEIU bargaining unit that represents low-paid seasonal workers also is in negotiation with city leaders for a new contract, said Ken Bare, a city parking control maintenance worker and SEIU chapter president for City of Santa Cruz workers.

- By Nov. 9, start a city council process to pay all city workers at least a living wage. The city’s living wage law sets a minimum wage for employees of outside contractors hired by the city. City workers have been exempt from that law, meaning some temporary, seasonal and other employees are paid less than that living wage.

- Brown wanted to remove that exception and bring all permanent and full-time city workers to a living wage rate by July 1, 2022 and all other eligible city workers by July 1, 2023.

- For the fiscal year that starts July 1, that “living wage” is $18.10 per hour for employees with benefits and $19.74 per hour for employees without benefits.

- There are 12 year-round city jobs that pay less than that living wage, Santa Cruz Human Resources Director Lisa Murphy said last month. About five employees are in those jobs, since many of those positions are not filled, she said. Also, almost all of the city’s 300 temporary and seasonal workers are paid less than that living wage. In a typical year, the city has about 400 to 450 temporary employees.

The proposal needed approval from three council members to be considered by the full council. However, Golder didn’t sign on. The latest Meyers could have called a special meeting was Thursday, at which point there was still no consensus on the living wage piece, Meyers and Golder said.

“I never got anything from them, so the timeline ran out,” Meyers said Thursday. “I’ve had my phone all week. I’ve picked up my phone everyday.”

Renee Golder (Kara Meyberg Guzman — Santa Cruz Local file)

In an interview with Santa Cruz Local, Golder said she didn’t feel comfortable approving the proposal without first analyzing the effects of such changes.

“The whole process felt extremely rushed. And committing to these expenditures after spending … two meetings, dozens of hours discussing our budget,” she said. “I didn’t feel comfortable with these expenditures without knowing what was going to be cut to cover the costs. I also wasn’t comfortable with my lack of time to do analysis on what the upstream effect would be on the rest of the city budget.”

The city’s salary plans include “steps” for each position — wage levels related to performance and length of service. Raising the lowest step to the living wage also would increase the higher steps. As a result, some temporary workers would make more than their supervisors, said Murphy, the human resources director.

Golder said the costs were unclear for pay raises for supervisors.

“It’s so complex, and there’s so many moving parts,” Golder said. “That being said, I would love to work towards making sure that everyone’s paid more money.”

What are the plans for the sales tax measure?

The next opportunity to bring a sales tax ballot measure to the voters would be for the June 2022 statewide primary, and it would need to be approved via the same fiscal emergency declaration by March 11, 2022.

If the city council cannot reach a unanimous vote by March, the sales tax could be placed on the November 2022 ballot without a fiscal emergency declaration, since two city council seats are up for reelection. The deadline for city council approval of the measure to make the November ballot is August 12, 2022. That vote would not need to be unanimous.

Until the city can move ahead on a new revenue source, it will still be strapped for resources and unable to provide all of the services it used to, Meyers and Schmidt said.

Brown said she is also working outside city hall to push for “more progressive revenue measures,” like a tax on homes that are sitting empty — a way to incentivize homeowners to rent, increasing the city’s housing stock. In the fall, she plans to circulate an empty homes tax proposal and gather signatures in an attempt to place it on a ballot in 2022, Brown said.

What’s next for the living wage proposal?

City of Santa Cruz lifeguards teach the Santa Cruz Junior Lifeguards program in July at Cowell Beach. City lifeguard salaries start at $15.63 per hour, which is less than the city’s minimum wage for outside contractors. (Kara Meyberg Guzman — Santa Cruz Local file)

Golder said she is still interested in changes to the city’s living wage ordinance, but that it might be more appropriate to take it up separately from the sales tax measure. Meyers said she is willing to consider bringing all city employees up to a living wage, but did not know the details of Brown’s proposal and didn’t agree with tying the living wage to the sales tax. Brown could bring the matter before council using the regular protocol: getting two other council members onboard.

“We always have to be looking at how to keep our employees at wages that are fair and also that are competitive, but we need a revenue source to do that,” Meyers said. “You can’t just commit to that without actually being able to pay for it. That’s what’s confusing to me in this whole situation.”

Related stories

- Santa Cruz council could tackle sales tax proposal, living wage (July 16, 2021)

- Santa Cruz sales tax hike stalls (June 23, 2021)

- Rising pension costs in Santa Cruz: Your questions answered (June 4, 2021)

Santa Cruz Local’s Kara Meyberg Guzman contributed to this report.

Become a member of Santa Cruz Local, an independent, community-supported newsroom that’s owned and led by local journalists. Our stories are free and always will be, but we rely on your support.

Already a member? Support Santa Cruz Local with a one-time gift.

Isabella Cueto is a bilingual journalist. She has covered a wide variety of local issues in Santa Cruz County, as well as South Carolina and South Florida.