Santa Cruz Local offers its news stories free as a public service.

We depend on people like you — we call them our Santa Cruz Local members — to chip in $9 a month or $99 a year to make sure vital information can be available to all. Can we count on your help?

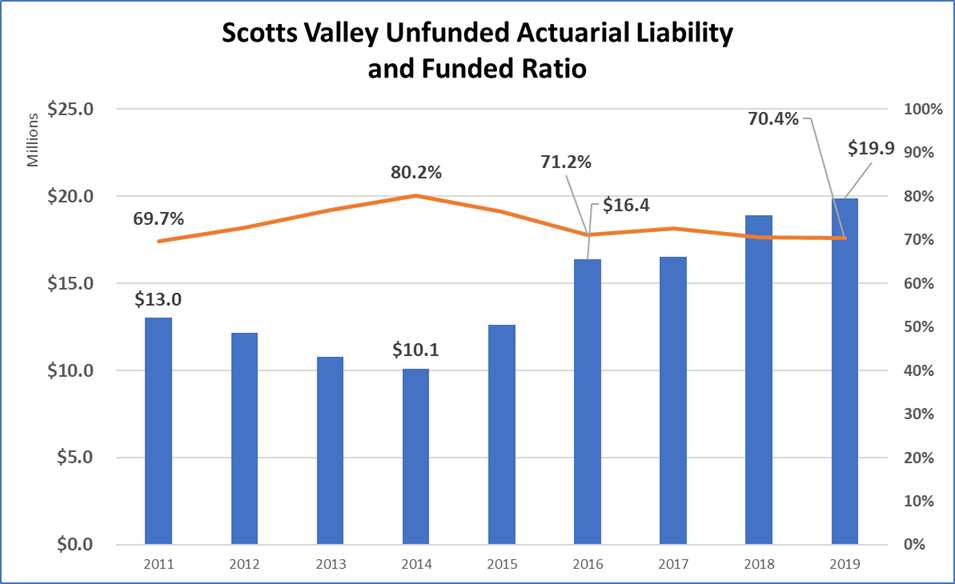

SCOTTS VALLEY >> Scotts Valley leaders decided Wednesday to take closer look at potentially risky pension obligation bonds to help pay the city’s roughly $19.8 million in unfunded pension debt. The debt has almost doubled since 2010, records show.

None of the council members were excited about the prospect of pension obligation bonds. City Manager Tina Friend said city staff would return with more information and options.

Pension obligation bonds are bonds that local governments issue when interest rates are low to help pay off unfunded pension liabilities. However, many experts consider those bonds risky because if the market crashes, the city’s debt grows.

“The single most important reason we have the fiscal crunch that we have today, is that pensions — our pension liability — is impacting our ability to provide core services,” said Vice Mayor Jim Reed.

“So much of the story of the city since I’ve been here has been, we’ve been in a boat with a bucket just bailing water out to keep ourselves afloat,” Reed said. “And the biggest reason that that’s the case is that while our revenues have grown at a modest rate in the time that I’ve been here, they haven’t grown anywhere near as fast as our employee costs. And that is largely made up of pension costs.”

Many California cities face pension problems. The California Public Employees’ Retirement System, the state agency that manages public pension funds, lost money on its investments during the last recession. CalPERS passes those losses on to cities and charges 7% interest.

In October, Reed proposed that city staff look into pension obligation bonds as an option. The concept is similar to refinancing a mortgage. Interest rates are near historic lows. Since CalPERS charges 7% interest, if a city can issue pension obligation bonds for a portion of its debt at a lower interest rate, it could save money if CalPERS achieves its expected return.

Wednesday, a city consultant estimated that the city could achieve around a 4% interest rate if it issued pension obligation bonds soon.

Risk

Some groups have criticized pension obligation bonds. The Government Finance Officers Association, a group that represents public finance officials across the U.S. and Canada, warns in a yellow banner across its website, “State and local governments should not issue POBs (pension obligation bonds).” Among its reasons, “The invested pension obligation bond proceeds might fail to earn more than the interest rate owed over the term of the bonds, leading to increased overall liabilities for the government.”

Despite the risk, city and state governments across the country issued $6.1 billion in pension obligation bonds last year. That was the highest annual amount since 2008, according to the research firm Municipal Market Analytics, reported this week by the New York Times.

Last year, Scotts Valley city leaders hired Steve Toler, a financial consultant with San Jose-based firm Management Partners, to lead city budgeting. They hired Toler in part because Administrative Services Director Tony McFarlane, who served as city finance director, was fired last summer and a new finance director has not been hired.

Wednesday, Toler compared the investment risk of pension obligation bonds to investors who bought GameStop stock at its peak a few weeks ago — when the stock fell, they lost their investment.

“The market is at an all-time high right now. And so I think that, if a (pension obligation bond) was issued, we have to recognize that there’s going to be some additional investment risk associated with paying off that obligation today,” Toler said. “Because if the market drops next year, you’re going to end up with a significant unfunded liability that has to be taken care of.”

History

The city already issued $4.5 million in pension obligation bonds in 2012 to help pay down its unfunded liabilities. City leaders expect to finish paying off its $2 million outstanding on those bonds by June 2025.

Toler said that the city saved money with that approach. In 2012, CalPERS’ expected rate of return (and the interest charged to cities) was 7.75%. The bonds were issued at an average rate of about 3.5%, Toler wrote in an email to Santa Cruz Local on Thursday.

“This saved the city money during that period on that portion of their debt,” Toler wrote, because interest rates were essentially cut in half.

Council members’ takes

All the council members expressed concern about the city’s pension debt and the risk involved with pension obligation bonds.

“It’s like a fantasy, really, because you’re giving us options that, on the one hand, help defray some of these costs, but they’re just loaded with tons of risk,” said Councilmember Randy Johnson. “I’ve been doing this a long time, but this is probably the most depressing segment of a city council meeting that I’ve ever experienced, simply because the options are so poor.”

Johnson asked city staff for more information — explained simply — about pension obligation bonds. Vice Mayor Reed acknowledged the risk and said it wasn’t his first choice, but the option deserved further consideration since interest rates are low.

Mayor Derek Timm said he worried about the bonds’ potential impact on the city’s ability to issue bonds for capital improvement projects. Cities have a cap on bond issuances. Timm said his concerns go even deeper.

“If we sign up for this and it exacerbates our problem — so the council that sees this, in 25 years comes in and goes, ‘Oh my god, they did this and now we actually ended up owing an extra $10 million,’” Timm said. “And I don’t I don’t know if it could ever be that bad. But that would be my worry.”

As Toler and city staff prepare a draft budget for the next fiscal year that starts July 1, they will examine options to address the city’s unfunded pension debt. The city council directed staff to look into the use of one-time funds to pay down unfunded pension debt.

In other news

The majority of the city council directed staff to not take applications from nonprofits for one-time grant funding for the next fiscal year. Until this year’s budget, the city had set aside roughly $40,000 in grant money for nonprofits such as Community Bridges, which runs a meal delivery program for seniors.

Timm, Reed and Johnson said that despite better-than-forecasted revenue, the city cannot afford the grants because of the pandemic’s economic effect. Councilmember Jack Dilles was in favor of putting $40,000 back in the budget for the grants.

On its consent agenda, the city council also unanimously approved a one-year memorandum of understanding with the Scotts Valley Police Bargaining Unit and the Scotts Valley Police Supervisors Association.

The memorandum of understanding includes:

- A greater share of police supervisors’ salaries will help fund their pensions. To align with state law, employee contributions to pension plans would increase to 9% of applicable salary, according to a city staff report.

- Salaries will increase 5% for the police bargaining unit and 8% for the police supervisors association.

The net cost to the city is expected to be $70,000 for the rest of this fiscal year and $140,000 in following years.

Kara Meyberg Guzman is the CEO and co-founder of Santa Cruz Local. Prior to Santa Cruz Local, she served as the Santa Cruz Sentinel’s managing editor. She has a biology degree from Stanford University and lives in Santa Cruz.