Santa Cruz Local offers its Scotts Valley City Council meeting recaps free as a public service. But our work costs money to produce.

Santa Cruz Local depends on memberships from people like you to make sure vital information can be available to all. Can we count on your help?

SCOTTS VALLEY >> The city of Scotts Valley’s COVID-19 related financial losses have not been as bad as city leaders forecasted in June, in part because of a rebound in hotel tax revenue and sales taxes from online shopping.

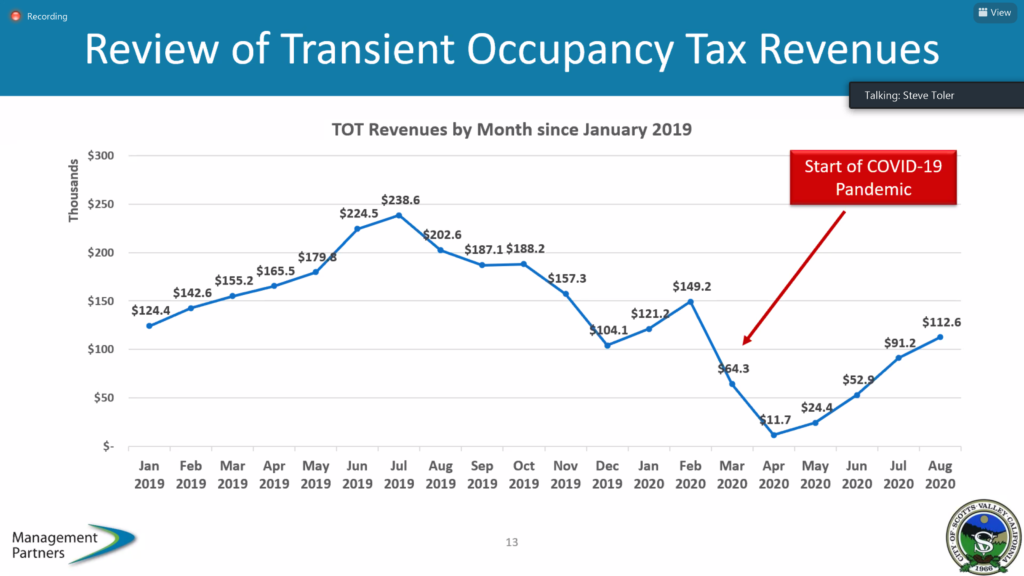

About one-fifth of the city’s general fund budget relies on the hotel tax — an 11% surcharge billed to hotel guests. Hotel tax revenue dipped to roughly $12,000 in April, compared with $165,000 a year prior. That revenue has climbed each month since April. In August, the city collected about $113,000 in hotel taxes, compared with $202,000 a year prior, according to a chart shared at a Scotts Valley City Council meeting Wednesday.

“Let’s face it, we were on an economic freight train that was going gangbusters prior to the pandemic occurring,” said Steve Toler, a financial consultant with San Jose-based firm Management Partners. “And so ultimately, at the end of the year, even with the effects of the pandemic on the last three months of the year, you finished higher than what the original budget was.”

Sales tax revenue accounts for about a quarter of the city’s general fund budget. The city’s sales tax raised $100,000 more than originally budgeted in 2019 for the fiscal year that ended June 30. Sales tax collected by the city from online purchases shipped to Scotts Valley helped boost that figure, city leaders said. Measure Z, a 3/4-cent sales tax increase approved by city voters in March, did not take effect until July.

City leaders hired Toler in recent months to review the budget in part because the city does not currently have a finance director. Tony McFarlane served as finance director earlier this year.

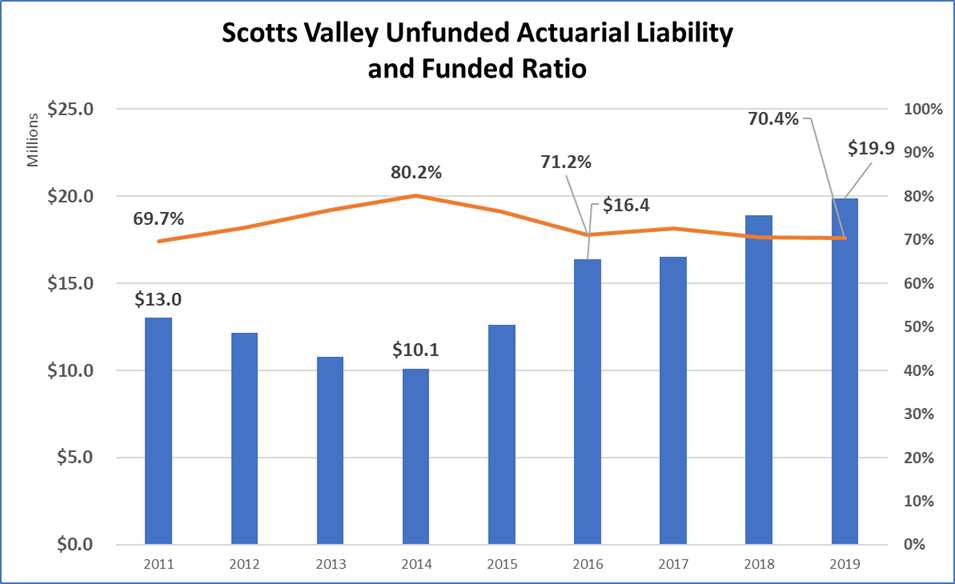

The city council took no formal action on the budget Wednesday. However, Councilmember Jim Reed requested that the city staff look into a possible pension obligation bond, to help pay for the city’s unfunded pension liabilities.

Pension trouble

Scotts Valley’s unfunded pension obligations have grown from $16.4 million in 2016 to $19.9 million in 2019, according to city charts.

Cities across the state face similar problems. The California Public Employees’ Retirement System, the state agency that manages public pension funds, lost money on its investments during the last recession. CalPERS passes those losses on to cities.

Pension obligation bonds are loans that local governments take when interest rates are low, to help pay off unfunded pension liabilities. However, some experts consider those bonds risky, since governments won’t know if the bond saves any money until the bond’s term ends.

“Pension obligation bonds are basically when jurisdictions make a bet that interest rates are going to go up in the future, and they bond against their future pension obligations,” Councilmember Reed said. “And in the past, that’s been something that I’ve compared to basically not too much different than us going to the craps table in Vegas, and playing with public money. It’s just a question of whether you were to look like heroes, depending on which way interest rates move, or will we look like goats, if it goes the other way.”

Reed’s day job is chief of staff for San Jose Mayor Sam Liccardo. Reed said San Jose is exploring possible pension obligation bonds. He said interest rates are at historic lows and can’t get much lower.

Councilmember Jack Dilles said, “I don’t like the idea. I’m certainly willing to listen to any analysis we may get.”

Dilles previously served as finance director for the cities of Santa Cruz, Scotts Valley and Morgan Hill. He is running for reelection on the Nov. 3 ballot.

“I know the Government Finance Officers Association now recommends, under any circumstances, not doing pension obligation bonds because of the risk and the leverage that could turn out to our favor, it could backfire big time. And you never know whether you win or lose with this borrowing against the borrowing. You don’t know until you pay the last bond off whether you made money or lost money,” Dilles said.

Scotts Valley issued pension obligation bonds in 2012, to help pay down its unfunded liabilities. City leaders expect to finish paying off its $2 million outstanding on those bonds by June 2025.

Toler, the financial consultant, said in an email to Santa Cruz Local on Thursday that pension obligation bonds are not for every agency.

Toler wrote, “If the POB [pension obligation bond] proceeds are used to payoff [sic] the unfunded liability and the CalPERS investment portfolio loses money in the next couple of years, the agency might find itself even further behind then if it had merely paid off the liability over several years.

“Some people think that once an agency pays off its unfunded liability, it’s gone for good. That is definitely not the case. It depends on what future investment markets do and the demographic trends of people living after retirement.”

Toler said the idea has not been evaluated. City staff are expected to bring the item back to the council before February.

Target coming to town

City leaders announced last week that a new Target store will fill the vacant Kmart building at 270 Mount Hermon Road.

Target bought the ground lease and the building, so the deal is final, but the opening date is unclear, Vice Mayor Derek Timm said in an interview Wednesday. Timm, along with Mayor Randy Johnson, led the recruiting effort to bring Target to town, several council members said.

The deal will bring sales tax revenue to the city and fill a need, Timm said. “When you talk to anyone in the community, they say there’s no easy place to buy socks or underwear … This just fills that in spades,” Timm said. “All the comments I’ve heard from the community have been incredibly positive. People are just like, ‘Get it open soon. We can’t wait to see them here.’”

The deal also moves the city toward a vision for a Town Center — it’s a development plan, decades in the making, for the area surrounding the Scotts Valley Library and former Kmart. It calls for denser housing, shops, restaurants and a town commons. Most of the plan has been slow to realize.

“I think one of the mistakes in the past that has plagued prior Town Center failures was, you need to know as a city what you want,” Timm said. “And I think, in some prior iterations, a developer would come in and say, ‘Hey, we want to do a project here,’ and then they would lay out the plan and then people would start shooting it down.’”

Hear the Scotts Valley City Council candidates’ answers to the question: “Why has the Town Center vision taken so many years to realize? What parts of the Town Center plan would you push in your upcoming term, and how?”

Wednesday, the council unanimously appointed Timm and Johnson to a two-member council committee in charge of identifying and coordinating future development opportunities for the Town Center plan. The committee’s term begins Nov. 1 and lasts a year.

Timm said he would push for the city to hire a consultant to drive the Town Center plan forward and have the community, not developers, lead how the plan is realized.

In other news

Wednesday, the council unanimously approved a wastewater bill credit program for businesses that had reduced operations March through May due to COVID-19 shutdowns. These businesses can request a one-time credit to their wastewater bill.

Also, at a future meeting, the council is expected to consider expanding the city’s inclusionary law. That law requires housing projects of a certain size to offer 15% of units to people with low incomes. The units have to be affordable. And that law applies to part of the city, generally along Scotts Valley Drive and Mount Hermon Road.

- Councilmember Jim Reed proposed that city staff look into an update to apply that affordability rule to the entire city.

- At a Santa Cruz Local candidate forum this month, Scotts Valley City Council candidate John Lewis and incumbents Donna Lind, Jack Dilles and Randy Johnson said they support expanding the areas to which the city’s affordability rule applies. Wednesday, Timm said he would support expanding the area.

- City Manager Tina Friend said Wednesday, “It’s not just a policy decision, there’s a lot of untangling with the former redevelopment association and various works. So it will actually take a lot of intricate planning work to actually implement and realize that change.” The city’s planning department has only two full-time staff. Still, Friend said she “will see what we can agendize.”

Kara Meyberg Guzman is the CEO and co-founder of Santa Cruz Local. Prior to Santa Cruz Local, she served as the Santa Cruz Sentinel’s managing editor. She has a biology degree from Stanford University and lives in Santa Cruz.