Read Santa Cruz Local's Election Guide

Measure B would raise occupancy taxes on vacation rentals and hotels in unincorporated areas of Santa Cruz County. This rental is near Twin Lakes State Beach in Live Oak. (Stephen Baxter — Santa Cruz Local file)

What is Measure B?

Measure B seeks to increase the tax on stays in hotels, motels, inns, or other commercial lodging in unincorporated areas of Santa Cruz County to 12%. The tax is now 11%. Measure B also raises the tax on vacation-rental stays to 14% from 11%.

If Measure B is adopted, it is expected to generate an additional $2.3 million annually. The money is not legally bound to be spent on a specific service, but it aims to fund “wildfire prevention, emergency response and recovery, street repair, public and mental health services, homelessness programs, and affordable housing,” according to a county resolution.

Measure B needs more than 50% of the vote to pass, according to the county clerk. Measure B will be decided by Santa Cruz County voters, including those who live in the four cities.

Where would Measure B apply?

Unincorporated areas of the county are areas outside the cities of Santa Cruz, Capitola, Watsonville and Scotts Valley. Unincorporated areas include Live Oak, Pleasure Point, and Aptos, Freedom, La Selva Beach, the San Lorenzo Valley, Davenport and many other areas.

What does a “yes” vote mean?

A “yes” vote on Measure B would raise the hotel and vacation-rental occupancy tax starting January 1, 2023. It supports the idea that visitors should pay a greater tax while staying within unincorporated areas of the county. It also supports the idea that the money raised should go to the county’s General Fund for general purposes that includes but is not limited to wildfire prevention, emergency response, street repairs and other essential services. If Measure B passes, it could only be changed by another public vote.

What does a “no” vote mean?

A “no” vote to Measure B means a vote against raising the tax on hotel and vacation rental stays. Voting against the measure means you support leaving the hotel and vacation rental tax at its current rate of 11%. It supports the idea that the revenue brought in from the current tax is enough already. It rejects the idea that the money brought in by the tax raise would benefit Santa Cruz County residents.

Things to consider about Measure B

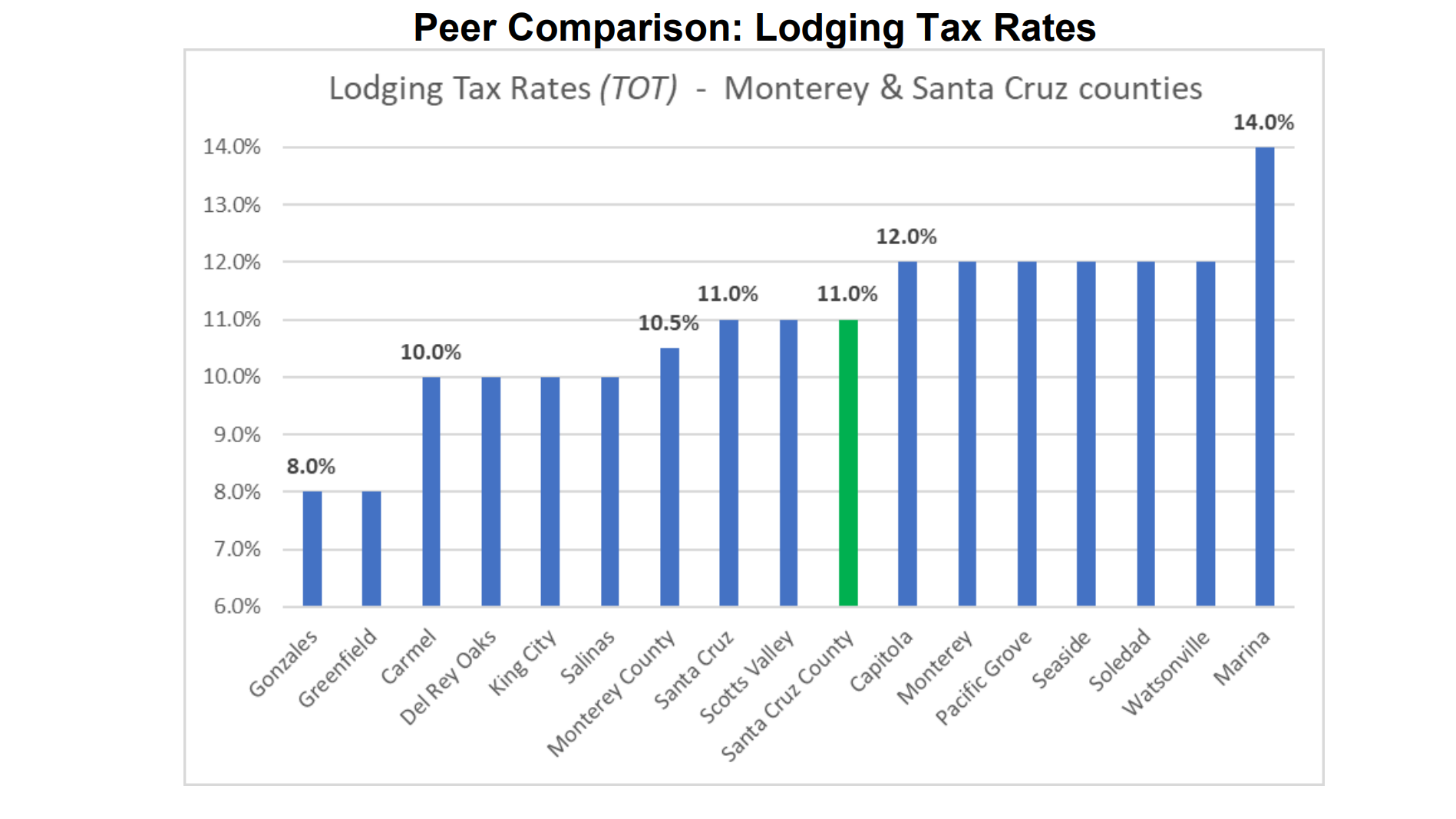

Hotel taxes for unincorporated areas of Santa Cruz County are now higher than Carmel’s at 10% and the same as the City of Santa Cruz’s at 11%. If raised to 12%, Santa Cruz County’s tax rate would be equal to those in Capitola, Watsonville and Monterey.

Santa Cruz County’s hotel tax is now on par with many nearby counties and cities. Measure B would raise it to 12%. (County of Santa Cruz)

Some Santa Cruz County residents pay to stay at vacation rentals in the county, so they would pay a higher tax.

If the measure is adopted, the tax would be paid by visitors of hotels, motels, inns and vacation rentals in unincorporated areas of Santa Cruz County.

If the tax rate for hotels, motels, and inns were raised to 12% from 11% on Jan. 1, county leaders estimate that it would add about $160,000 in revenue in the first year and add $440,000 to prior hotel tax revenue for the county’s fiscal year 2023-24, according to a county staff report. The fiscal year starts July 1.

For vacation rental properties, the tax would rise to 14% from 11% and generate about $700,000 in the first year and add $1.9 million to the prior vacation-rental tax base for the county’s fiscal year 2023-24, according to a county staff report.

Proponents of Measure B have said that all the money from the tax hike will stay in Santa Cruz County and by law, none can be taken from the state.

Opponents of Measure B argue the money taken from the tax hike are not directed toward specific services. That is accurate. The text of Measure B does not specify what the money will be used for. The county resolution on Measure B states that the money will be used for “general purposes in order to continue funding essential public services including wildfire prevention, emergency response/recovery, street repair, public/mental health services, homelessness programs, and affordable housing.”

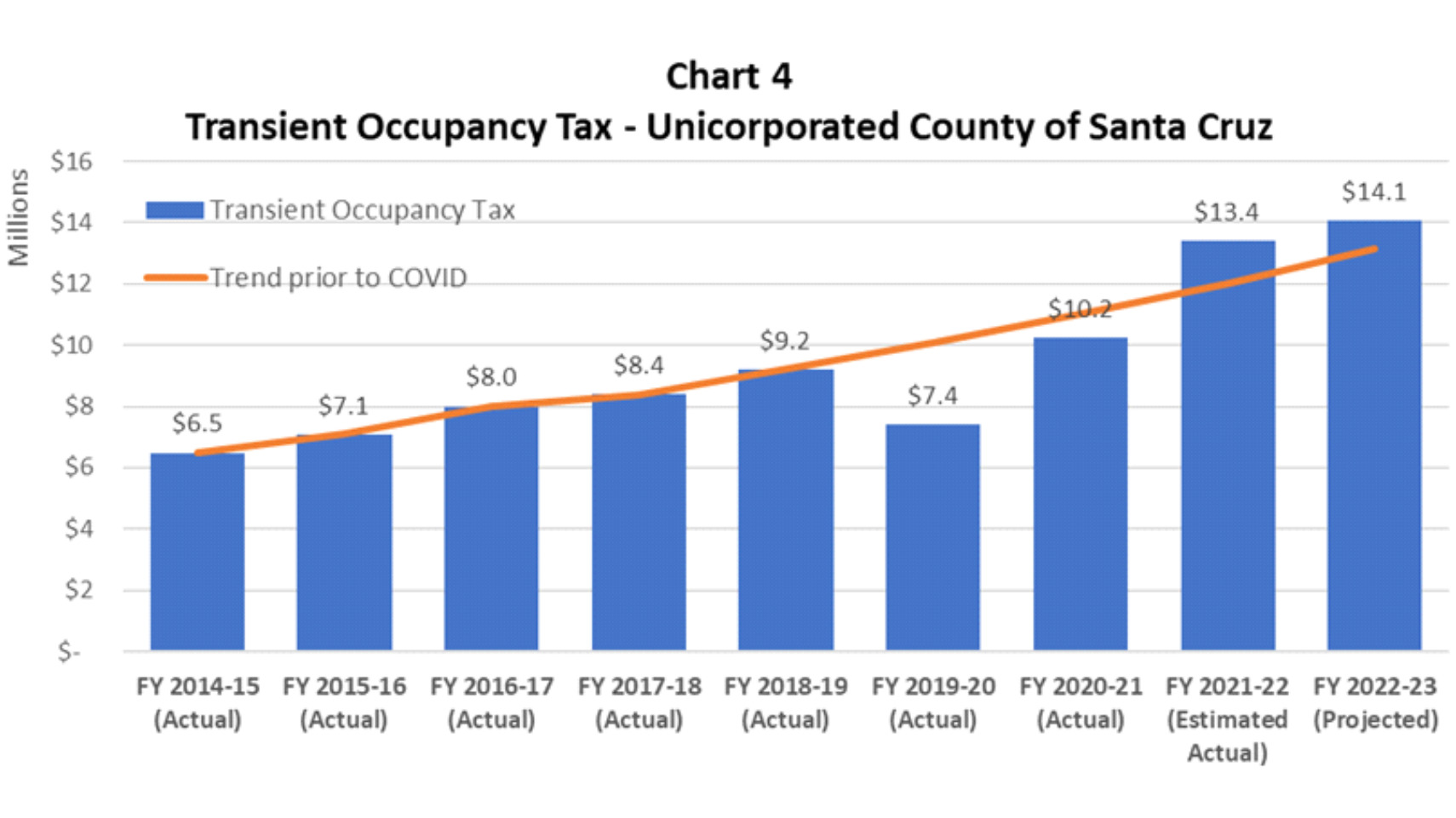

The county’s tax on hotel and vacation-rental visitors rose in 2021 after a dip during COVID-19 restrictions in 2020. The taxes are a top source of revenue for the county’s general purposes, county leaders have said. (County of Santa Cruz)

County leaders have separated taxes on hotel stays and stays in vacation rentals because:

- There are more rules and laws related to vacation rentals in unincorporated areas of Santa Cruz County compared with hotels.

- There are more impacts on residential neighborhoods especially in areas “not typically subject to the impacts of commercial endeavors,” according to a county staff report.

- There are development impact fees and permit costs on hotels and not vacation rental properties. Vacation rentals are usually private homes.

More information on Measure B

Santa Cruz Local stories on Measure B

- Hotel tax hike, disposable cup tax could be on ballot – Feb. 13, 2022

—Allison Gasparini

Santa Cruz Local’s news is free. We believe that high-quality local news is crucial to democracy. We depend on locals like you to make a meaningful contribution so everyone can access our news. Learn about membership.