Property tax revenue is a key part of the County of Santa Cruz’s budget. (Stephen Baxter — Santa Cruz Local file)

Property taxes are a key part of the budgets of the County of Santa Cruz, school districts in the county and several other agencies.

Property owners in Santa Cruz County typically are taxed annually at 1% of the government-assessed value of their property. The assessed value is usually lower than the market value.

Proposition 13, adopted by California voters in 1978, limits the growth of the assessed value of a property to 2% per year. Properties are typically reassessed when they’re sold. That means longtime property owners in California whose properties have increased in market value pay lower property taxes than recent buyers.

Property tax rates essentially cannot be raised, except through voter initiatives for specific purposes. To increase revenue for county services, county leaders commonly rely on sales taxes, transient occupancy tax and voter-approved bonds to raise money, said Marcus Pimentel, Santa Cruz County budget manager.

Property tax revenue accounts for nearly 14% of the county’s roughly $1.2 billion adopted budget for Fiscal Year 2023-2024, according to county documents. Intergovernmental revenue, charges for services and other sources also contribute to the budget.

Property tax revenue is split between the county government, cities, school districts and special districts for services like water and fire protection.

Santa Cruz County property tax apportionments

State legislation following Proposition 13 froze the apportionments of property tax in Santa Cruz County and every other county in the state. Each group receives about the same percentage of the tax today as they did in 1978. Local governments cannot change their apportionments.

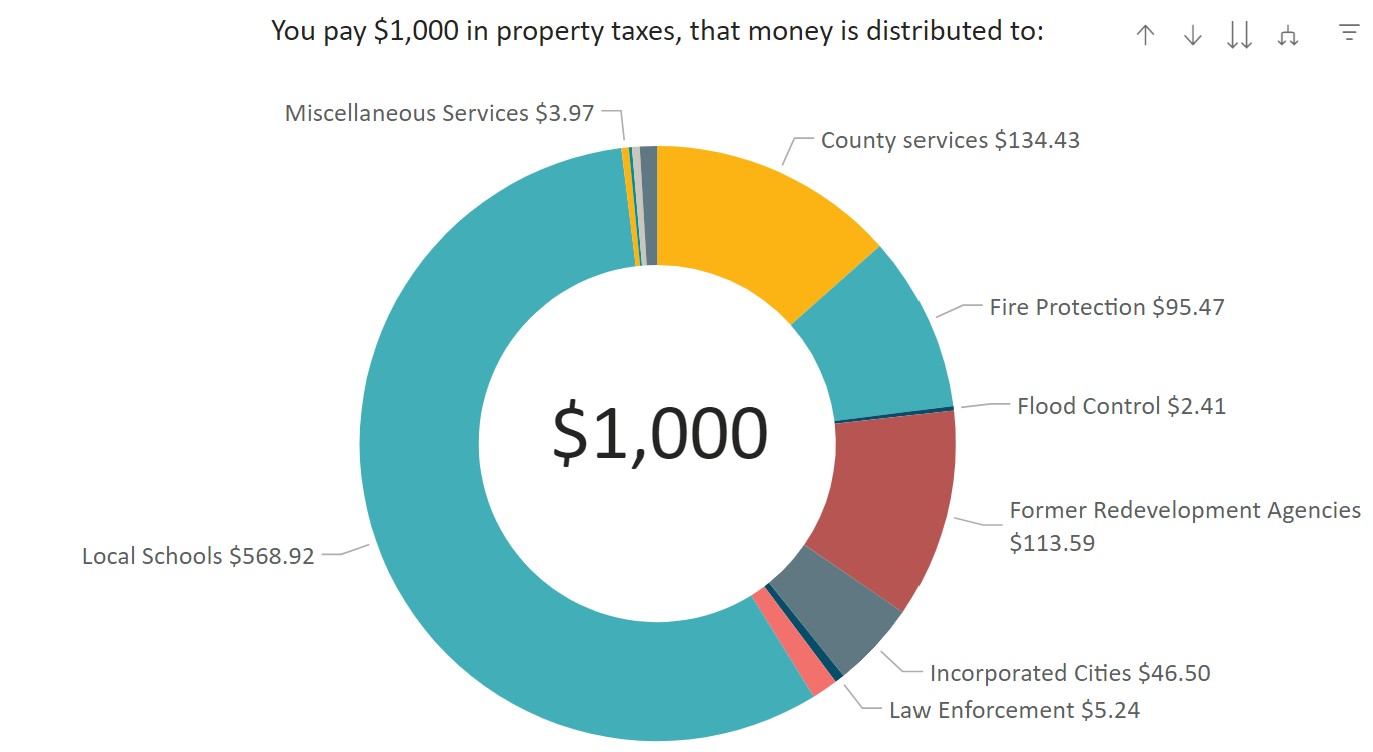

Santa Cruz County’s property tax apportionment for Fiscal Year 2022-2023:

- School districts: 57.1%

- County government: 13.5%

- Cities: 4.6%

- County libraries: 1.4%

- Santa Cruz County Fire: 0.5%

- Other districts in the county: 22.9%

The county government receives about 13.5% of property taxes, according to county documents. That money can be used for any county infrastructure or services, including roads, behavioral health programs and county jails, county leaders said.

Two additional funds collect money specifically for county libraries and fire departments. County libraries receive about 1.4% of property taxes. Santa Cruz County Fire receives about 0.5%.

A County of Santa Cruz chart breaks down the distribution of each $1,000 paid in property taxes for Fiscal Year 2021-2022. (County of Santa Cruz)

Cities

Santa Cruz County’s four cities receive a combined 4.6% of property tax revenue collected from county property owners.

- Santa Cruz receives 2.9%. In the 2022-2023 budget, property tax revenue contributed to 5.4% of the city’s budget, according to city records.

- Scotts Valley receives 0.2%. In the city’s 2023-2024 budget, property tax revenue contributed to 5.3% of the budget, according to city records.

- Capitola receives 0.3%. In the city’s 2023-2024 budget, property tax revenue contributed to 16.5% of the budget, according to city records.

- Watsonville receives 1.2%. In the city’s 2023-2024 budget, property tax revenue contributed to 21.6% of the budget, according to city records. Watsonville produces a biennial budget.

Schools

Santa Cruz County’s 10 school districts receive a combined 57% of property taxes collected in the county. Nearly all property tax dollars stay within the county except for the Education Revenue Augmentation Fund that goes to the state.

The fund, known as ERAF, was created in 1992 to bolster state funding of school districts. Essentially, Santa Cruz County pays a portion of its property taxes to the state, and then receives some of that money back as state funding for schools.

Nearly 12% of Santa Cruz County property tax revenue goes to ERAF, according to county documents.

Special districts

Special districts in Santa Cruz County receive about 12% of property taxes collected in the county.

Most special districts only levy taxes on property owners living within their boundaries. But 42 districts created before Proposition 13 are included in the apportionment for the entire county. They include districts for water, parks and recreation, fire protection and other services.

Some special districts include:

- Pajaro Valley Fire Protection District.

- Lompico County Water District.

- Davenport County Sanitation District.

Redevelopment agencies

About 11% of property tax dollars go towards the debts of redevelopment agencies.

Redevelopment agencies essentially formed to invest in new development in blighted communities throughout California. In Santa Cruz County, redevelopment agencies were formed in the City of Santa Cruz, Watsonville, Capitola, Scotts Valley and Live Oak.

In 2012, the state dissolved these agencies, and successor agencies were formed to pay their debts. Any property tax money redeveloper successor agencies received that is not needed to make debt payments is redistributed to cities and the county. Once those debts are paid off, the successor agencies will dissolve and no longer receive money.

Questions or comments? Email [email protected]. Santa Cruz Local is supported by members, major donors, sponsors and grants for the general support of our newsroom. Our news judgments are made independently and not on the basis of donor support. Learn more about Santa Cruz Local and how we are funded.