Measure X – Scotts Valley business tax

Scotts Valley voters will consider a business tax increase with Measure X in the Nov. 5 election.

Measure X would raise the base rate for an annual business license to $150 from $90, and charge higher rates for businesses that bring in larger annual revenues.

The increased rates would bring in about $750,000 more for Scotts Valley than it now collects annually in business taxes, according to a city staff report. If voters approve Measure X, the city is poised to receive about $1.1 million annually in revenue from business licenses.

Scotts Valley’s General Fund is about $40 million. The city council agreed to use about $4 million in reserves to cover its expenses in a city budget it adopted in June.

Measure X needs more than 50% of the vote to be adopted.

What is Measure X, the Scotts Valley business tax?

Measure X is a proposal to “modernize” the fees for business licenses in Scotts Valley. The rate businesses pay to operate in Scotts Valley was last set in 1992 and did not include adjustments for inflation, which has more than doubled since then. The measure was placed on the ballot by the Scotts Valley City Council.

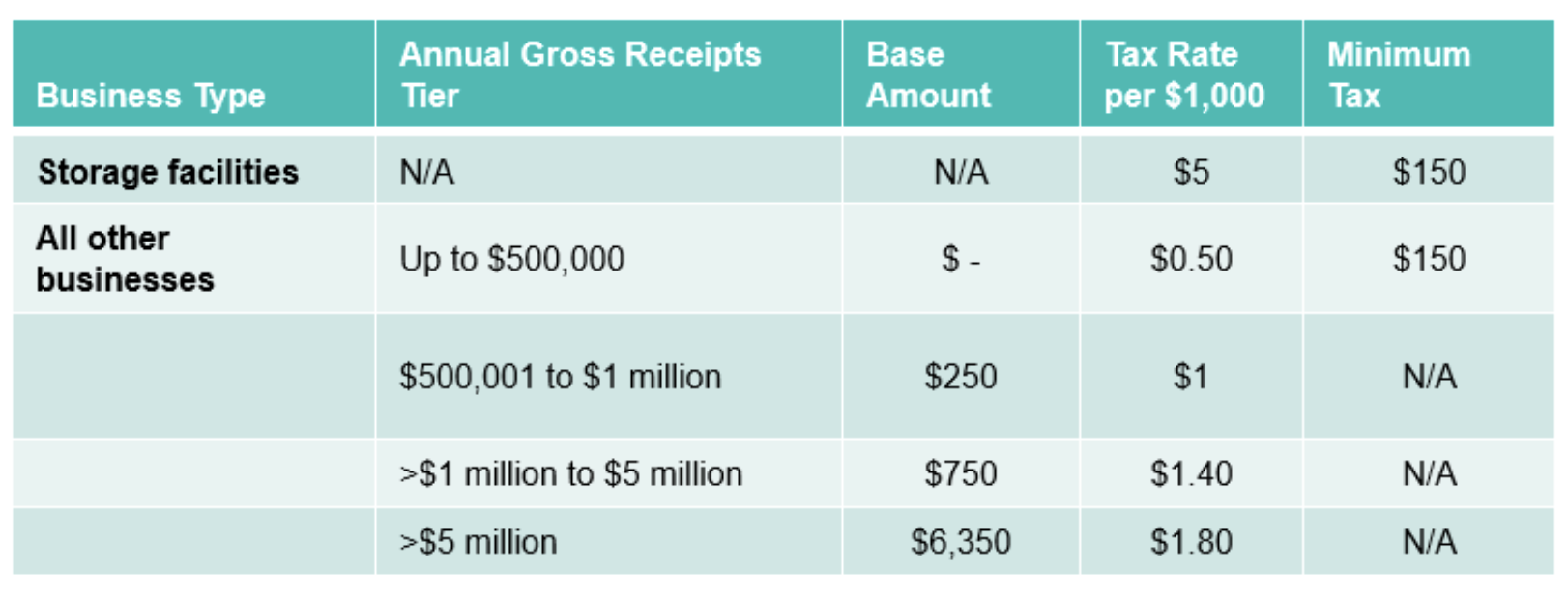

A four-tier rate structure for the business tax is proposed based on gross annual receipts. Businesses that bring in more revenue annually would be charged a higher rate. Storage facilities would be charged a flat rate of $5 per $1,000 in annual gross receipts.

The new rates would become effective in a two-year phased approach, with 50% of the increase effective in Fiscal Year 2025-2026 and 100% of the new rates effective in Fiscal Year 2026-2027.

A proposed fee structure would charge most businesses based on annual gross receipts. (City of Scotts Valley)

What is the text of Measure X?

“City of Scotts Valley Business License Modernization. To maintain city services, such as repairing potholes/streets; wildfire prevention programs, maintaining parks/playfields; and other critical governmental services, shall a measure modernizing Scotts Valley’s 1992 business license ordinance be adopted, until ended by voters, raising the base rate from $90 to $150 per business and with rates increasing incrementally for larger businesses based on gross receipts as provided in the ordinance, generating approximately $1,100,000 annually, and all funds controlled locally?”

What does a “yes” vote mean?

A “yes” vote would change business license fees in Scotts Valley. The base rate would increase to $150 from $90 and businesses that bring in more money in gross annual receipts would pay a higher annual fee.

What would a “no” vote mean?

A “no” vote would not change Scotts Valley’s business license fees.

Where would the money go?

Money from the increased fees would go into the city’s General Fund and could be used for any city purpose.

Arguments for Measure X

In an argument filed in favor of the measure, Scotts Valley Mayor Randy Johnson, Scotts Valley Chief of Police Steve Walpole and others said the tiered-rate fee structure would be more fair than the current structure.

“Measure X will make sure that small businesses only pay a modest increase, while larger companies will pay a fee based on the amount of revenue they generate. Larger companies rely more heavily on City Services, and Measure X will help better cover their impacts and Needs,” they wrote.

“Like many California and Bay Area communities, the economic fallout from the COVID-19 pandemic has exacerbated the challenge to fund the City of Scotts Valley’s critical community Services,” Scotts Valley City Manager Mali LaGoe wrote in an Aug. 7 city council meeting report.

“Without increased revenue, deep budget reductions will be required starting in Fiscal Year 2025/26. These reductions would further degrade services prioritized by the community, including street repairs, park maintenance, wildfire preparedness and public safety,” LaGoe wrote.

Arguments against Measure X

No argument was filed against Measure X.

City resolution text and more information

Other Scotts Valley elections

- District 5 Santa Cruz County supervisor

- Scotts Valley City Council

- Scotts Valley Unified School District

- Measure O – Scotts Valley Unified school bond

- Measure S – Scotts Valley Fire bond

—Nik Altenberg